Bli gjeldfri til 17.mai

Vi gjør det igjen! Nå nedbetaler vi inntil 250 000 kr i forbruksgjeld til enda en Horde-bruker.Full oversikt over økonomien + nyttige varsler

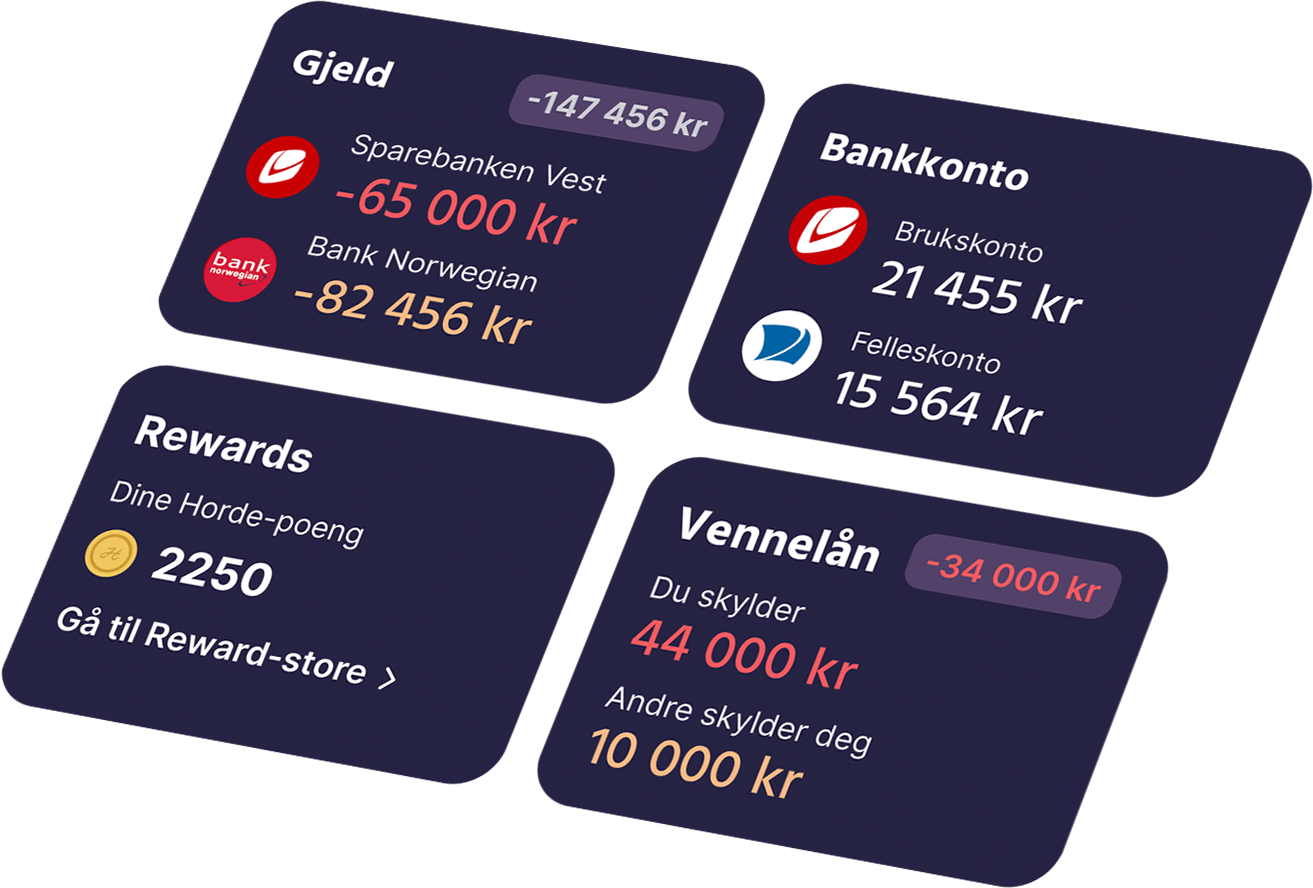

Se dine kredittkort, bankkontoer og forbrukslån - alt på et sted. Bli varslet når kredittkort blir rentebærende, når du bør reforhandle boliglån, forsikringer etc.

Bli belønnet for gode økonomiske valg

Med Horde Rewards tjener du poeng som du kan bytte i ekstra nedbetaling av gjeld, gavekort eller premier.

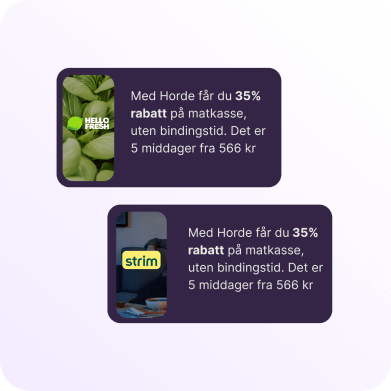

Se ditt forbruk og finn gode deals

Se ditt forbruk inndelt i kategorier og sammenlign med andre brukere. Få gode tilbud og tilgang til tips og nyttige verktøy.

Sett opp låneavtaler med venner og familie

Bli enig om betingelser, gjennomfør betalinger, følg med på lånet og mye mer.

Horde-Partnere

140 000 kr over 5 år, effektiv rente 13,29 %, kostnad 49 168 kr, totalt 189 168 kr

Effektiv rente på 8,55 % ved et lån på 2 millioner over 25 år, kost kr. 2.622.146, totalt kr. 4.622.146.

Abonner på vårt

nyhetsbrev

Ved å abonnere får du jevnlig nyheter og informasjon fra Horde på e-post. Du kan når som helst melde deg av. Se vår personvernerklæring for mer informasjon.